noun

- an excise tax based on the value added to a product at each stage of production or distribution: value added is arrived at by subtracting from the total value of the product at the end of each production or distibution stage the value of the goods bought at its inception. Abbreviation: VAT

noun

- (in Britain) the full name for VAT

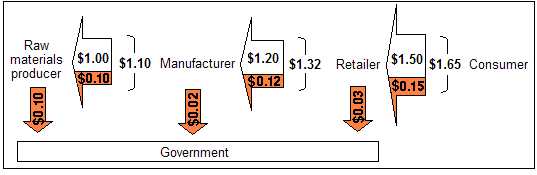

A tax on the value added to a product at each stage of its production, from raw materials to finished product. Widely employed in Europe, value-added taxes have the advantage (for governments) of raising revenue “invisibly,” that is, without appearing as taxes on the bill paid by the consumer.

Liberal Dictionary English Dictionary

Liberal Dictionary English Dictionary